THE WINE CAPITAL 3s STRATEGY™

WINE CApital’S PROVEN METHODOLOGY BEHIND WINE EVALUATION

Our firm’s strategy is to acquire investment-grade wines globally, with an initial focus on France (Bordeaux, Burgundy and Champagne) and Italy (Tuscany).

We apply an analytical, data-driven approach to the sourcing and safeguarding of assets. It utilises weather satellite and historical pricing data to determine the best regions and vintages and to make informed decisions on the direction of the overall market.

With wine, timing is everything. Wine Capital Wine Fund will hold the assets for a period of time between acquisition and sale that is sufficient to permit material capital appreciation, typically through a combination of maturity, scarcity and the addition of value during the holding period.

This constant cycle of evaluation and monitoring is the unique Wine Capital Wine Fund “3S Strategy”, ensuring the fund value is always optimised.

THE 3S STRATEGY™

Selection

Inside knowledge of when to buy and sell

Backed by market trends & modelling data

Proven history

Storage

UK based bonded & temp conrolled

Fully secured & insured

Protect & increase the market value

Non-taxed

Selling

Inside knowledge of when to buy and sell

Backed by market trend & modelling data

Proven history

OUR FINE WINE SELECTION CRITERIA

The wine we invest in must qualify at a minimum under the following criteria:

Located in a bonded warehouse or come directly from the producer.

Over three previous vintages outperformed the chosen benchmark over the last two decades.

Sufficient historical secondary market volume with a minimum of five vintages traded on the secondary market within the last three years.

THE WINE CAPITAL WINE FUND TERMS

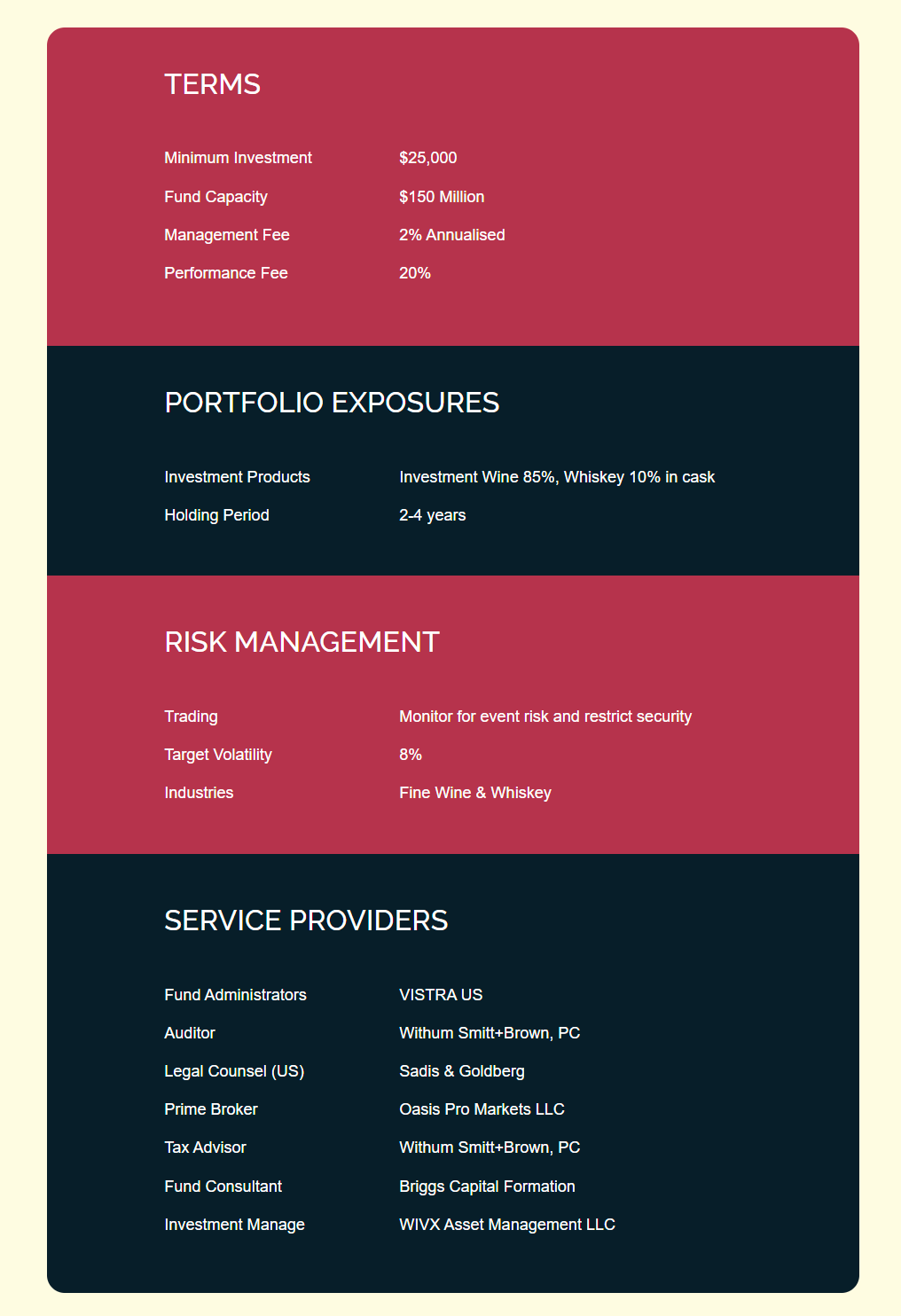

TERMS

Minimum Investment

Fund Capacity

Management Fee

Performance Fee

$25,000

$150 Million

2% Annualised

20%

Portfolio Exposures

Investment Products

Holding Period

Investment Wine 85%, Whiskey 10% in cask

2-4 years

Risk Management

Trading

Target Volatility

Industries

Monitor for event risk and restrict security

8%

Fine Wine & Whiskey

Service Providers

Fund Administrators

Auditor

Legal Counsel (US)

Tax Advisor

Fund Consultant

Investment Manager

VISTRA US

Withum Smitt+Brown, PC

Sadis & Goldberg

Withum Smitt+Brown, PC

Briggs Capital Formation

Bjork Capital Management LLC